In any case, you should know that how you make money. Indeed, it’s not something complicated. Coming from companies that pay you, the offers for economic products you observe on your platform.

While making money, it allows you to provide you the access to get free credit records. It’s not a big issue that you’re working with big or smaller accounting firms in North Vancouver. But, it matters much that where and how your products come into view on your platform.

However, you try to confirm you provide a good match since you usually make money while finding a proffer you want to get. Thus you might be nervous while filing your business taxes for the starting year. That’s why we’re going to share some tips from the best lawyer in Vancouver. that will help you.

Plan Your Tax Structure

To better explain this area, get the number of owners you keep in mind. It’s because, by-laws, an LLC might be classified as taxes as a single proprietorship, partnership, or a corporation for federal tax reasons.

When it comes to the domestic LLC that has one owner will treat as a single proprietorship. But, if it has two or more proprietors will classify as a partnership unless they get the selection as a corporation.

Identify What You May Deduct

You desire to put aside money anyhow you can if you have started s new small business. This means taking away as many costs as possible for lots of entrepreneurs. When it comes to the rule deduction, they should be as ordinary as necessary.

For example, something that is very common in the line of job and appropriate for what you’re doing. If you use a car for business purposes, then keep its mileage in mind while filing the taxes. It should count definitely. But, very few businesses can disagree against how essential these are fro your work life.

Know-How You Categorize Your Employees

The question that arises in the tax season is how to define people’s jobs in your business. Also, it’s important to know if they’re independent contractors or employees. It’s because employees will get the right to have some things.

These include worker’s compensation, minimum wage, unemployment insurance, payroll taxes, and overtime pay. When the rules have not evidently defined, you mislabel the independent contractors and employees.

In this case, the IRS can consider it as an effort to keep away from paying taxes of payroll. Because it can go ahead to back taxes and penalties, you should be aware of labeling employees work for your company.

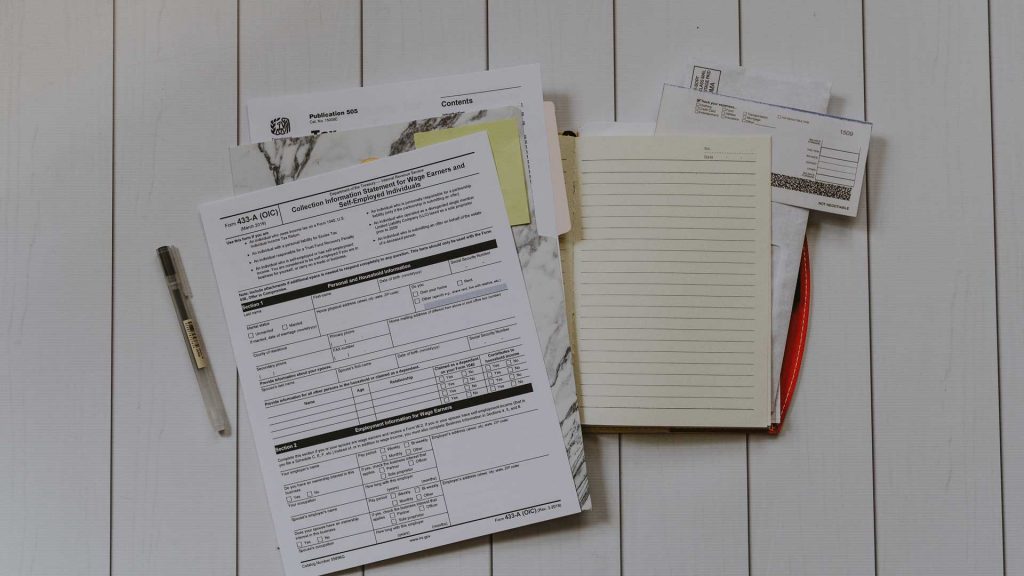

Keep Records Of Receipts And Paperwork Of The Entire Year

While going this way, it’ll help you getting something more than just the tax season. As an entrepreneur all at once, it’ll develop your career if you make the practice of good business in the beginning as a company owner.

But, it’ll facilitate the method along for tax period while keeping your important and related paperwork in a single place plus saved every receipt.